Take Control of Your Business Finances

Running a business is enough of a rollercoaster, your finances shouldn’t be. The Boutique COO’s Fractional CFO services help you get clear on your numbers, improve cash flow, and make more confident financial decisions, minus the full-time CFO price tag.

Whether you need an Outsourced CFO, CFO Consultant, or Part-Time CFO, we provide the financial planning & analysis expertise your business needs. We make the money side of your business make sense.

Grow your brand & elevate your marketing strategy

Financial Planning & Forecasting

Our Fractional CFOs develop cash flow projections to ensure your budgets are aligned with the company's strategic goals.

Pricing Strategy & Profitability Analysis

From reviewing your margins and competitive pricing models to profitability ratios, we help optimize pricing approaches to boost margins while staying competitive.

Financial

Modeling

We map out financial projections with detailed spreadsheets that help you understand and confidently plan your future finances.

Cash Flow Oversight & Budgeting

Establish a budget and maintain robust internal controls to safeguard the company's budget and ensure accurate financial reporting.

Pricing Strategy & Profitability Analysis

From reviewing your margins and competitive pricing models to profitability ratios, we help optimize pricing approaches to boost margins while staying competitive.

Investor &

Funding Support

Need funding? We assist with venture capital loans, crowdfunding investment strategies, and startup investment to secure capital for growth.

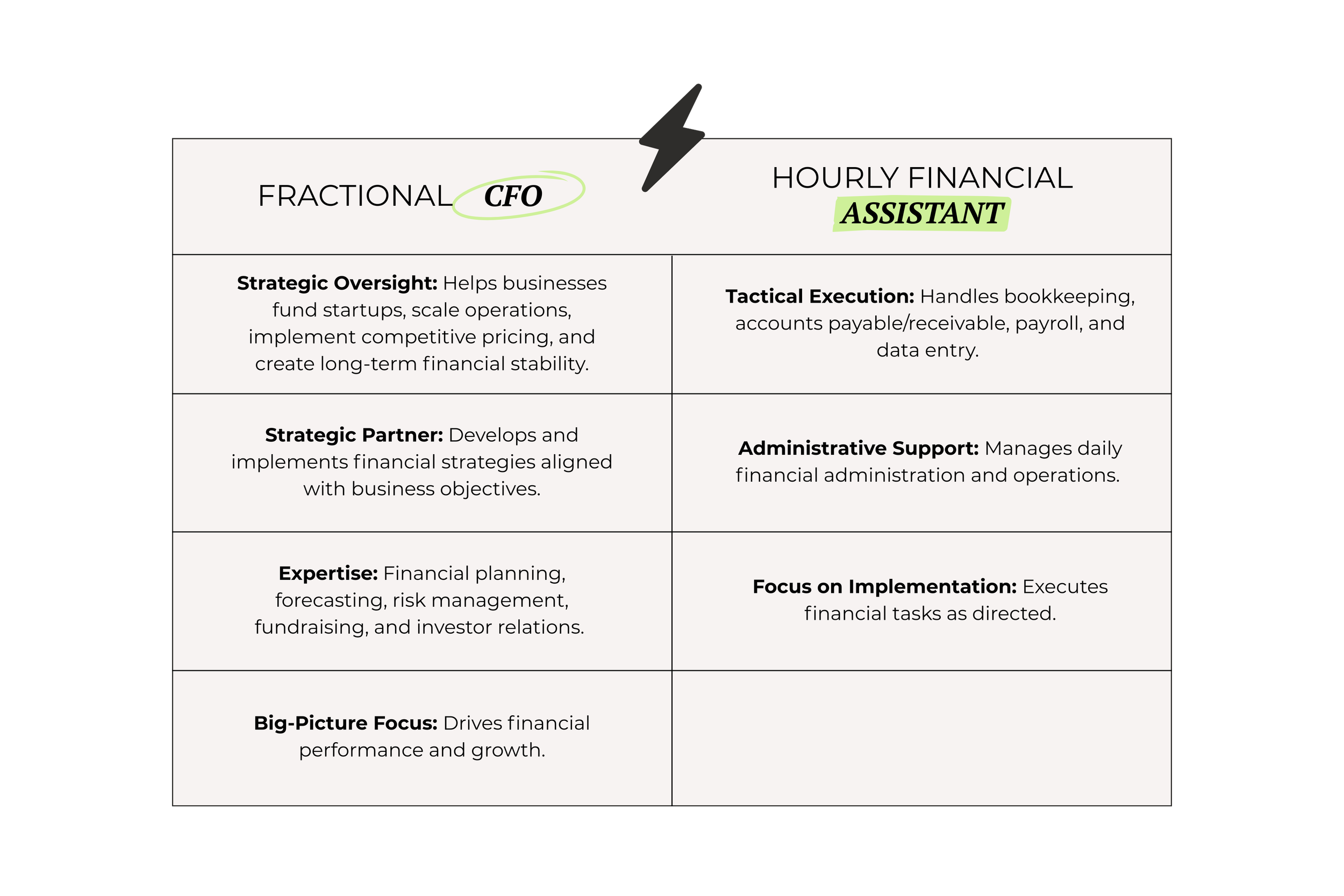

FRACTIONAL CFO vs. AN HOURLY FINANCIAL ASSISTANT

A Fractional CFO provides the strategic vision and financial leadership, while a Financial Assistant focuses on the day-to-day execution of financial tasks. The best approach? A CFO for big-picture planning and an assistant for smooth operations.

Does your business only need hourly financial support?

Check out the SMB Staff Accountant page.

WHY HIRE THE BOUTIQUE COO AS YOUR FINANCIAL ADVISOR?

EXPERIENCE WITH BUSINESSES OF ALL SIZES

Our advisors have 15+ years of combined experience launching & growing businesses ranging from large Fortune 500 companies to small, solopreneur-led brands.

PRACTICAL, ACTIONABLE ADVICE TO IMPLEMENT

We’ve nurtured 100+ SMB businesses and managed more than $50B in capital. So, we like to skip the fluff about “mindset” & aim to provide practical business, operations, & finance strategy.

EXPERTISE IN DRIVING REAL BUSINESS RESULTS

Our team has worked in-house at various businesses, from startups to fortune 500 companies & know what initiative to implement to drive an average of $1m in revenue growth.

APPROACHABLE, JUDGEMENT-FREE SUPPORT

Our founder built TBC to 7 figures within a year, and our team brings over 15 years of combined experience, from startups to Fortune 500 companies, so we know exactly which strategies can deliver an average of $1M in revenue growth. We skip the one-size-fits-all “rules” and tailor initiatives that match your specific business goals, because we believe there's no single right way to succeed.

Need to gain financial clarity & control of your business?

Together, we can build a financial strategy that helps create a path for your business to grow this year.

Fractional CFO FAQs

-

There are several reasons to bring on a Fractional CFO, but some of the top reasons we see are:

You’re not sure where your money is going

You need support building financial projects or financial strategy

You’re looking to fundraise

You need support developing a pricing strategy

-

We can develop a scope of work that is customized to fit your needs and budget. In most cases, your Fractional CFO will begin with more hours in the first few months to forecast and develop strategy and then reduce hours from there, to continue supporting as needed. These hours may range from 10 hrs a month all the way up to 20 hours a week, depending on what stage your business is at.

-

This varies from business to business. Often clients find that they need more COO hours up front and then can actually wean off as time goes on. When your business reaches a point where your financial systems are thriving, you could potentially reduce hours. That being said, if you plan to continue expanding your business, then it would make sense to bring on a full time COO.

DISCOVER HOW WE CAN HELP YOU ACHIEVE THE WORK-LIFE BALANCE YOU DESERVE.

No need to prepare anything. Just come discuss your business challenges & we’ll come up with an action-oriented plan to streamline your operations.

It might actually be kinda therapeutic.

NOT QUITE SURE YET?

Our Early-Stage Incubator Program is a great place to start.

Made for owners and founders who are:

→ Just starting out

→ Working with a lower budget (typically ~$500 or less / month)

→ Want to test out working with us before diving in